- No Comments

- By admin

- plot in yeida ,

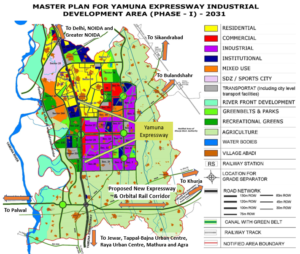

Yeida authority Plots: Online Allotment Status, Legal Safety & Financing Guide

Buying Yeida authority plots is one of the safest ways to invest in land in India, especially when the plots are allotted by a government development authority. For buyers and investors looking at planned development, transparent pricing, and long-term appreciation, authority plots offer clarity and peace of mind. However, many people still feel confused about checking allotment status, understanding ownership rights, arranging bank finance, and completing legal verification.

This detailed guide is written to help real buyers—not just to explain concepts, but to walk you through real-world decisions you’ll face when investing in authority plots. Whether you are a first-time buyer or a long-term investor, this article explains how to check allotment status online, leasehold vs freehold ownership, loan options, and legal precautions, all in simple and trustworthy language.

How to Check Authority Plots Allotment Status Online

Checking the allotment status of authority plots online is a straightforward process, but it must be done carefully to avoid misinformation.

Step-by-Step Online Process

- Visit the official website of Yamuna Expressway Industrial Development Authority

- Navigate to the “Plot Scheme” or “Allotment Status” section

- Select the relevant scheme year and plot category

- Enter your application number or registration ID

- Submit the details to view the allotment status

The system displays whether the plot is allotted, under process, waitlisted, or not allotted.

Key Details to Verify

- Plot number and sector

- Applicant name

- Payment stage and balance dues

- Possession or lease deed status

Always cross-check the details with your official allotment letter. If discrepancies appear, contact the authority directly through registered channels.

Why Online Verification Matters

Online verification protects buyers from fraud and misinformation. Many unauthorized agents falsely claim availability or allotment, so checking the status yourself ensures you are dealing with authentic authority plots.

Guide to Leasehold vs Freehold Plots in Authority Developments

Understanding ownership rights is critical before investing in authority plots.

What Is a Leasehold Plot?

In a leasehold arrangement:

- The land is leased to the buyer, typically for 90 years

- Ownership remains with the authority

- The buyer has full usage rights, construction rights, and resale rights (with conditions)

Most YEIDA plots are leasehold in nature.

What Is a Freehold Plot?

In a freehold setup:

-

- The buyer owns the land permanently

- No lease renewal is required

- Fewer restrictions on resale and transfer

Some authority plots can be converted from leasehold to freehold after meeting specific conditions.

Leasehold vs Freehold Comparison

|

Feature |

Leasehold | Freehold |

|

Ownership |

Authority retains land | Buyer owns land |

|

Duration |

Usually 90 years | Permanent |

| Conversion | Possible (with fee) |

Not required |

| Bank Loans | Widely accepted |

Fully accepted |

| Resale | Allowed with rules |

Freely allowed |

Which Is Better for Buyers?

Leasehold authority plots are legally secure, government-backed, and suitable for both self-use and investment. Freehold plots offer flexibility but often cost more and may lack planned infrastructure.

Bank Loans & Financing Options for Authority Plots

Financing is a major concern when purchasing authority plots, but the good news is that banks readily fund government-allotted land.

Loan Eligibility for Authority Plots

Most banks consider authority plots as low-risk due to:

- Clear title

- Government allotment

- Planned development zones

Banks Commonly Offering Loans

- Public sector banks

- Private banks

- Housing finance companies

Loan approval depends on:

- Applicant income and credit score

- Allotment letter authenticity

- Plot location and authority approval

Loan Amount & Tenure

- Up to 70–80% of plot value

- Tenure ranges from 10 to 20 years

- Construction-linked loans available later

Documents Required

- Allotment letter

- Payment receipts

- Lease deed (if executed)

- Authority-approved layout plan

- Applicant KYC documents

Financing is also available for plots located along the Yamuna Expressway authority plot zones, as these areas are officially notified and well-regulated.

Legal Considerations Before Buying Authority Plots

Legal due diligence is the most critical step when buying authority plots.

Verify the Allotment Letter

Ensure the allotment letter:

- Is issued directly by the authority

- Matches the plot number, sector, and area

- Shows correct payment schedule

Check Encumbrance Status

Authority plots are usually encumbrance-free, but always:

- Request a no-dues certificate

- Confirm no pending authority notices

Understand Transfer Rules

Authorities impose conditions on:

- First transfer timeline

- Transfer charges

- Lease rent and maintenance dues

Failing to follow transfer rules can lead to penalties or cancellation.

Confirm Land Use Category

Check whether the plot is:

- Residential

- Commercial

- Industrial

Using a plot for unauthorized purposes can result in legal action.

Avoid Common Buyer Mistakes

- Never rely solely on brokers

- Do not pay booking amounts without verification

- Avoid plots without official allotment proof

Consulting a legal expert familiar with authority plots is always a wise step.

Why Authority Plots Near Planned Corridors Are in Demand

Authority plots located near major infrastructure corridors benefit from:

- Planned road networks

- Future metro and rail connectivity

- Industrial and commercial zones

The Yamuna Expressway region continues to attract end-users and investors due to long-term development planning and government-backed execution.

Frequently Asked Questions (FAQs)

1. Are authority plots safe for long-term investment?

Yes, authority plots are among the safest land investments due to government ownership and regulated allotment.

2. Can I sell a leasehold plot?

Yes, resale is allowed after meeting authority conditions and paying transfer charges.

Conclusion

Authority plots offer a rare combination of legal security, affordability, and future growth. By learning how to check allotment status online, understanding ownership structures, using safe financing options, and following legal best practices, buyers can invest with confidence.

Whether your goal is self-construction or long-term appreciation, authority plots—especially in well-planned regions—remain a reliable and transparent real estate choice.